Launching a software product in 2026 requires navigating a market where both opportunity and competition have intensified. While digital products are now central to business models across industries, the realities behind startup execution remain challenging. CB Insights’ analysis of hundreds of startup post-mortems shows that no market need is the second most common reason startups fail, accounting for 35% of cases. This pattern highlights how misaligned product decisions – often driven by weak validation or delayed feedback – remain a primary driver of failure, even before execution or scaling challenges emerge.

Even within established organizations, digital transformation efforts often fall short. A Gartner survey of more than 3000 CIOs and technology leaders found that only 48% of digital initiatives meet or exceed their expected business outcomes. Success depends on precise methodology, rapid iteration, strong communication between stakeholders and engineers, and early data collection to validate assumptions. Without these elements, teams risk building products that are expensive but ineffective. At the same time, the software ecosystem is expanding rapidly. Global IT spending on software is expected to reach $6.15 trillion by the end of 2026, growing more than 10% year over year, making it the fastest-growing segment of IT. This growth is driven by continued investment in cloud-based platforms, AI-enabled applications, and recurring software services as organizations accelerate digital transformation and modernize core systems.

This article explores the essential considerations for early-stage software development: the differences between startup and enterprise teams, effective methodologies, modern technology stacks, the role of analytics, how to build a functional MVP, what strong development partners contribute, and how to choose the right partner.

The challenges outlined in the introduction raise a structural question: who is better positioned to deliver early-stage software: early-stage product teams or enterprise delivery teams? Understanding how each operates provides clarity on which model aligns with the needs of rapid product iteration in 2026.

The ability to form high-performing development teams is shaped by the global shortage of technical talent. Workforce projections estimate a deficit of 85.2 million skilled workers by 2030, representing $8.5 trillion in potential unrealized revenue. As a result, companies of all sizes increasingly blend in-house teams with external specialists, nearshore partners, or managed service providers to close capability gaps and sustain momentum.

This shift mirrors the distribution of developers worldwide. In 2023, there were over 26 million software developers globally, with significant clusters in China, the United States, and India. Importantly, half of these developers work in teams of two to seven people, a structure typical of startups where small, autonomous teams enable faster decision-making, tighter feedback loops, and direct ownership of product outcomes, and 88% work in groups of fewer than twenty, which demonstrates an industry-wide reliance on compact, cross-functional units rather than large hierarchical teams.

Half of developers worldwide work in teams of two to seven people, making the startup-style structure the industry norm.

Modern software development increasingly favors teams that can move quickly, communicate directly, and iterate without heavy procedural overhead. This configuration (long associated with startups) is now prevalent even inside large enterprises, which increasingly break work into small, autonomous pods to accelerate delivery.

A concise comparison illustrates the strengths and limitations of each model:

| Factor | Startup teams | Enterprise teams |

|---|---|---|

| Speed | High; short decision cycles enable rapid iteration | Slower; dependencies and approval layers affect pace |

| Team structure | Small, cross-functional pods | Larger, multi-layered organizational units |

| Flexibility | Very high; priorities can shift quickly | Moderate; changes require coordination |

| Communication | Direct and informal | Structured, often involving multiple stakeholders |

| Resource focus | Narrow, dedicated to a limited number of projects | Spread across broader organizational initiatives |

Taken together, these differences show that startup teams are structurally optimized for speed, focus, and adaptability, making them better suited for early-stage product development where requirements evolve quickly. Enterprise teams, by contrast, are designed to manage scale, coordination, and risk, which can slow iteration but supports stability in mature, complex environments.

For early-stage software projects, where requirements evolve rapidly and market validation is essential, compact teams tend to perform more effectively. Their size allows for focused execution, their structure supports continuous learning, and their adaptability makes them well-suited to environments where priorities can shift weekly. Enterprises provide process discipline and scalability, but these strengths are often outweighed by coordination overhead and slower delivery rhythms during an MVP or prototype phase.

This does not diminish the value of enterprise experience; it simply underscores that early-stage products benefit most from teams capable of moving quickly, collaborating closely, and integrating external expertise when specialized skills are required.

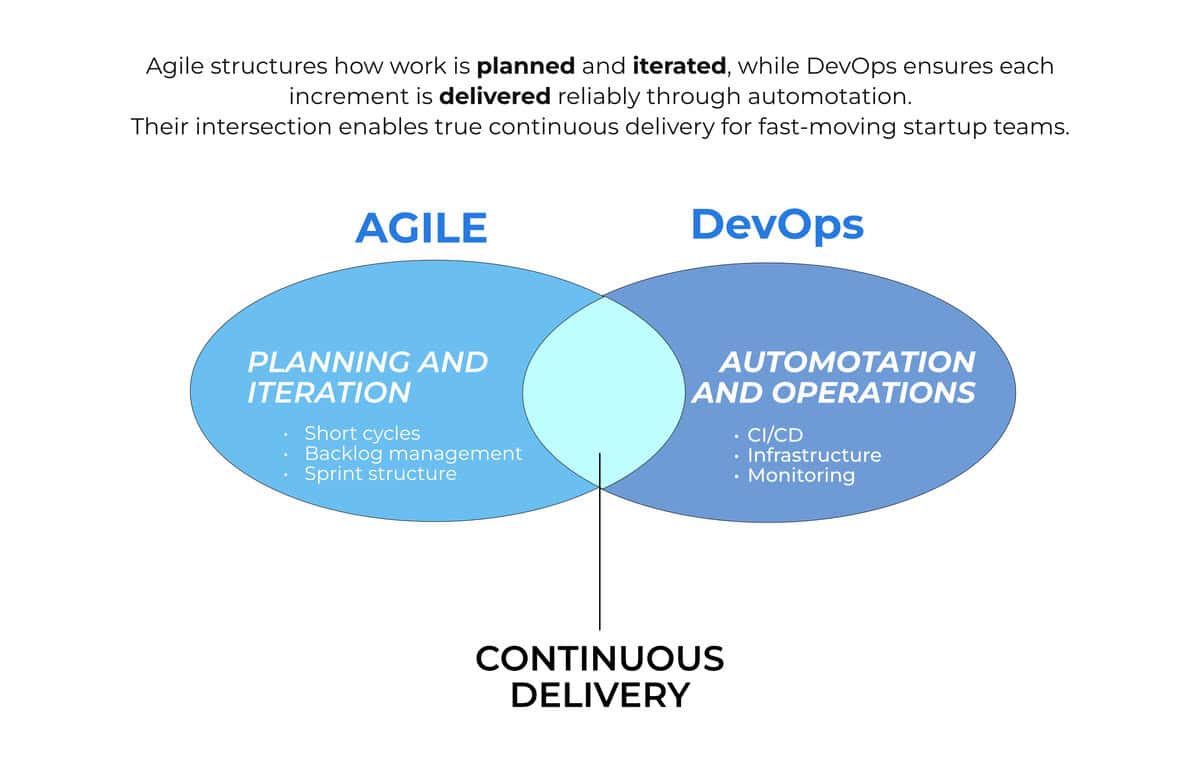

Modern software development relies heavily on methodologies that support rapid iteration, close collaboration, and the ability to adjust scope as market insights emerge. For startups, these qualities are not optional but foundational. Choosing the right development methodology influences delivery speed, product quality, and the team’s capacity to respond to early user feedback.

Agile remains the prevailing development approach across industries. According to recent industry surveys, 71% of companies now use Agile practices in their software development lifecycle, making it the most widely adopted methodology. This dominance is closely tied to the increasing need for flexible planning, continuous delivery, and frequent reassessment of priorities – factors that strongly align with early-stage product development.

Within Agile, Scrum is used by 63% of Agile teams, particularly when product requirements evolve rapidly and teams must operate in short, focused cycles. At the enterprise level, frameworks such as SAFe (Scaled Agile Framework) have gained traction. While SAFe is generally too structured for early-stage startups, it highlights a broader trend: as companies grow, Agile becomes more formalized to maintain consistency.

For startups, Agile is effective because it supports fast learning under uncertainty. Short sprints allow teams to test features against real user feedback within weeks, adjust priorities without formal change processes, and limit wasted development on unvalidated ideas. Regular reviews and retrospectives help founders and small teams quickly identify what is not working, whether in scope, implementation, or product direction, and correct course before costs compound.

Development methodologies increasingly blend Agile practices with DevOps principles. 42% of organizations report using hybrid Software Development Life Cycle (SDLC) models, a combination of Agile, DevOps, and other approaches, to gain both speed and operational reliability.

For early-stage teams, this often means:

This combination enables faster releases while ensuring that quality, testing, and deployment processes remain stable as the product evolves.

Early-stage products succeed when teams iterate quickly, validate assumptions often, and avoid building more than the market currently demands.

A notable shift in 2024-2025 is the deeper integration of AI tools into everyday development workflows. Industry reporting shows that the use of AI-assisted tooling in Agile environments increased from 64% to 84% within a single year, while 74% of organizations now operate under some form of hybrid Agile model. Rather than experimenting at the margins, teams are embedding AI directly into core delivery processes.

For startups, AI adoption is typically pragmatic and focused on speed and efficiency. Common tools such as GitHub Copilot, ChatGPT-based assistants, Cursor, and AI-enabled testing frameworks are increasingly used to support:

While AI does not replace architectural decision-making or deep engineering expertise, it significantly reduces time spent on repetitive or low-leverage tasks. For startup teams operating with limited headcount, constrained budgets, and aggressive timelines, this translates into shorter development cycles, faster feedback loops, and more capacity to focus on product-critical work.

For early-stage companies, the primary objective is learning quickly with minimal waste. Agile and hybrid models support this by:

As the product matures, startups may introduce more structured elements, such as formalized release cycles or additional QA processes, but the early reliance on iterative delivery remains central to long-term success.

Technology choices play a central role in how quickly startups can deliver a first version of their product and scale efficiently. The global steady growth underscores a landscape where rapid development is increasingly supported by cloud-native tools, managed services, and mature cross-platform frameworks. For early-stage companies, the right stack enables teams to launch faster without sacrificing long-term flexibility.

Cross-functional teams, increasingly augmented by AI-assisted coding tools such as Cursor and GitHub Copilot, enable startups to reach their first release in weeks, not months.

Flutter

Flutter remains one of the most efficient frameworks for rapid mobile development in 2026, adopted by 46% of software developers globally. Its single codebase for iOS, Android, web, and desktop significantly reduces development time, while its UI toolkit offers consistent performance across platforms. Features such as “Hot Reload” and a unified widget architecture allow teams to iterate quickly, an advantage during MVP development when interface changes and user feedback cycles are frequent.

React Native

React Native continues to be widely adopted (42% of developers globally) due to its strong JavaScript ecosystem and interoperability with native modules. Its declarative component model allows teams to build interfaces quickly, while its vast library ecosystem shortens implementation timelines. For teams already familiar with React for web development, React Native reduces the learning curve and enables faster delivery of cross-platform mobile experiences.

Both frameworks, while differing technically, serve a similar purpose: they help startups deploy mobile applications in significantly shorter timeframes compared to fully native development.

Firebase and Supabase

Platforms such as Firebase (Google) and Supabase (open source) offer backend-as-a-service capabilities that dramatically shorten development setup. Authentication, real-time databases, serverless functions, storage, and analytics are available out of the box. This allows teams to focus on core product logic rather than backend scaffolding. Such tools are especially useful in MVP phases, where the priority is launching a functional product quickly.

Serverless architectures

Serverless computing, through services like AWS Lambda, Google Cloud Functions, and Azure Functions, enables lightweight backend development with minimal operational overhead. Since infrastructure provisioning and scaling are handled by the cloud provider, teams can deploy individual features faster and adjust capacity automatically as usage grows. This reduces early development time while maintaining scalability.

Fast prototyping is essential for early-stage product development. Tools such as Figma, Whimsical, and MockFlow allow teams to create and iterate on wireframes in real time, collaborate asynchronously, and gather feedback before development begins. This approach minimizes rework by ensuring usability issues are identified early. Prototyping also supports smoother sprint cycles, as teams enter development with clearer UI flows and validated assumptions.

Many applications – marketplaces, SaaS tools, healthcare platforms, education apps – require built-in chat or video capabilities. Modern APIs significantly reduce build time for these complex features.

These platforms prevent teams from spending months building communication layers from scratch and instead allow developers to focus on differentiated functionality.

PWAs remain a strategic option for startups that need a mobile-friendly experience without the cost of native development. They offer offline support, background sync, push notifications, fast loading times, and a near-native user experience. In 2026, PWAs are increasingly used for early product versions, internal tools, and lightweight consumer applications where installation friction must be minimized.

However, PWAs still face notable limitations on iOS, including restricted push notification support, limited background execution, and a less intuitive installation flow compared to Android. As a result, iPhone users often experience reduced feature parity and higher onboarding friction, which should be factored into platform strategy decisions.

Across all categories, the value lies in how these technologies:

However, these gains depend heavily on selecting the right technology stack from the outset. Early architectural choices influence development speed, scalability, hiring flexibility, and long-term maintenance costs. For startups, misaligned stack decisions can slow iteration, introduce unnecessary complexity, or require costly rewrites as the product evolves.

Working with a reliable development partner helps mitigate these risks. Experienced teams can assess product requirements, growth plans, and team capabilities to recommend stacks that balance speed, flexibility, and future scalability. This guidance allows early-stage teams to build functional products faster while reserving engineering capacity for areas that directly affect user experience and market differentiation.

As development accelerates and teams adopt modern tooling, the next critical question becomes how to validate product assumptions. For early-stage companies, data is not an optional enhancement but the foundation for decision-making. Without early instrumentation, teams risk relying on intuition rather than evidence – one of the most common causes of product misalignment. In 2026, analytics capabilities are not only accessible but directly correlated with business outcomes, making them essential from the earliest development stages.

The global data analytics market reached approximately $65 billion in 2024 and is projected to expand to about $658.64 billion by 2034, with a strong 29.4% CAGR. This rapid growth reflects the increasing emphasis companies place on data-driven decision-making. Equally telling is that 89% of organizations report that data- and analytics-driven digital transformation initiatives have had a positive impact on profitability. This shift underscores a broader industry consensus: companies that integrate analytics early are better positioned to make financially sound decisions.

For startups, where runway is finite and every iteration carries a cost, this relationship between analytics and profitability is especially relevant. Instrumenting an MVP from the first release by embedding event tracking, usage metrics, and basic conversion funnels into the product enables teams to observe how users behave, identify friction points, and determine whether initial assumptions hold. This shifts development from speculative to evidence-based, reducing risk and increasing the probability of product-market fit.

Modern analytics platforms allow teams to gain clarity much earlier in the product lifecycle. Tools such as Google Analytics 4, Mixpanel, Amplitude, LogRocket, and FullStory provide insights into user behavior, funnel performance, retention patterns, and conversion pathways. Because these solutions integrate easily with modern stacks, including Firebase and serverless backends, teams can deploy tracking quickly without heavy engineering overhead.

The business impact of adopting structured product analytics is well-documented. A Forrester Total Economic Impact study found that an organization using a product analytics platform achieved a 217% return on investment over three years, with payback occurring in under six months. While individual results vary, the study highlights a consistent trend: early investment in analytics yields disproportionately high returns by preventing misdirected development. For startups, the mometrics (activation events, feature usage, drop-off points, and retest valuable early data includes core user behavior ntion), alongside basic financial indicators such as burn rate, runway, customer acquisition cost, and early revenue signals. Tracking these inputs from the first releases helps teams link product decisions to both user outcomes and financial sustainability, reducing uncertainty as the product evolves.

Once implemented, analytics enable startups to answer essential questions:

This information supports rapid iteration, clearer prioritization, and more accurate resource allocation. It also enables structured A/B testing, allowing teams to validate variations in onboarding flows, pricing, messaging, or UI elements before committing to significant development work.

Product validation is not a single event but a continuous process woven into every sprint. By tracking usage from day one, startups create a feedback loop that informs design, engineering, and business strategy. This reduces the likelihood of building features users do not want, a common cause of wasted runway, and helps align the product roadmap with measurable user behavior.

In a market where digital initiatives often fail to meet expectations, robust analytics give early-stage companies a measurable advantage. They transform the development process from guesswork into an iterative, evidence-driven cycle that supports long-term scalability and financial sustainability.

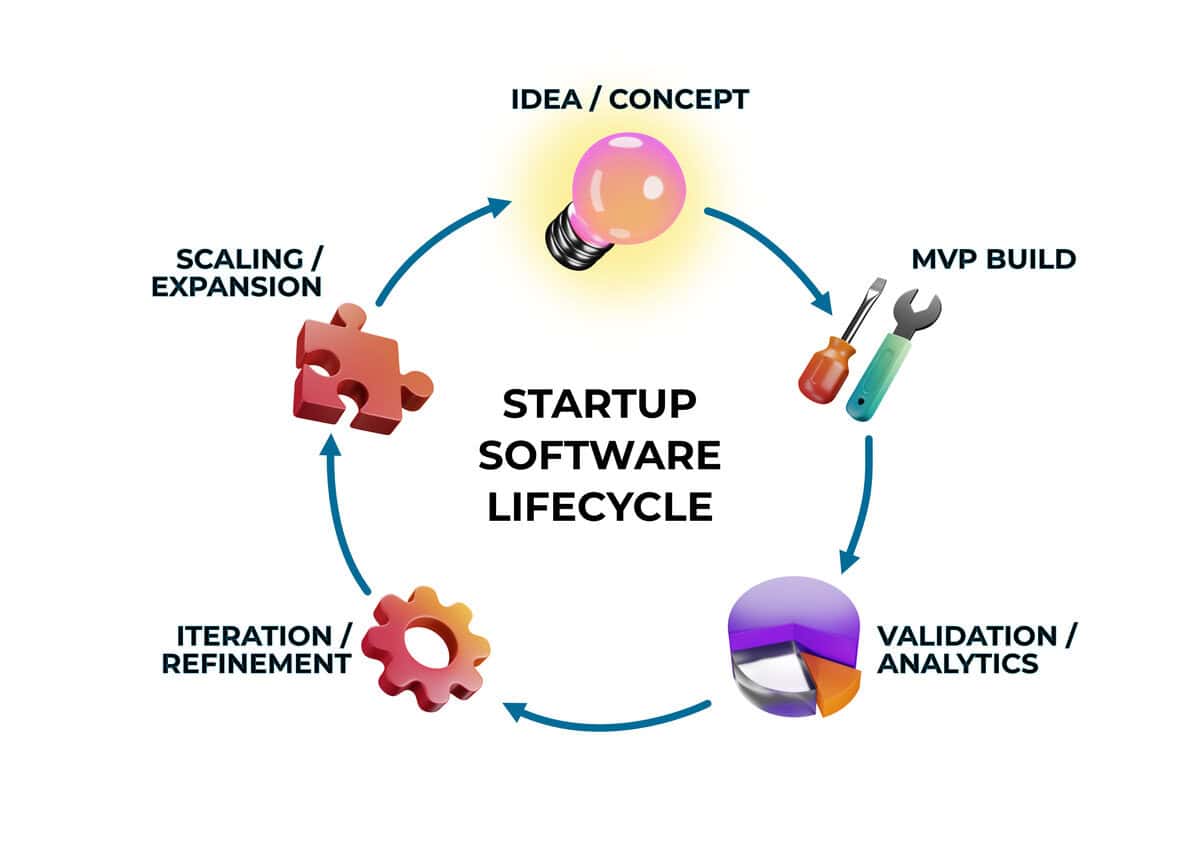

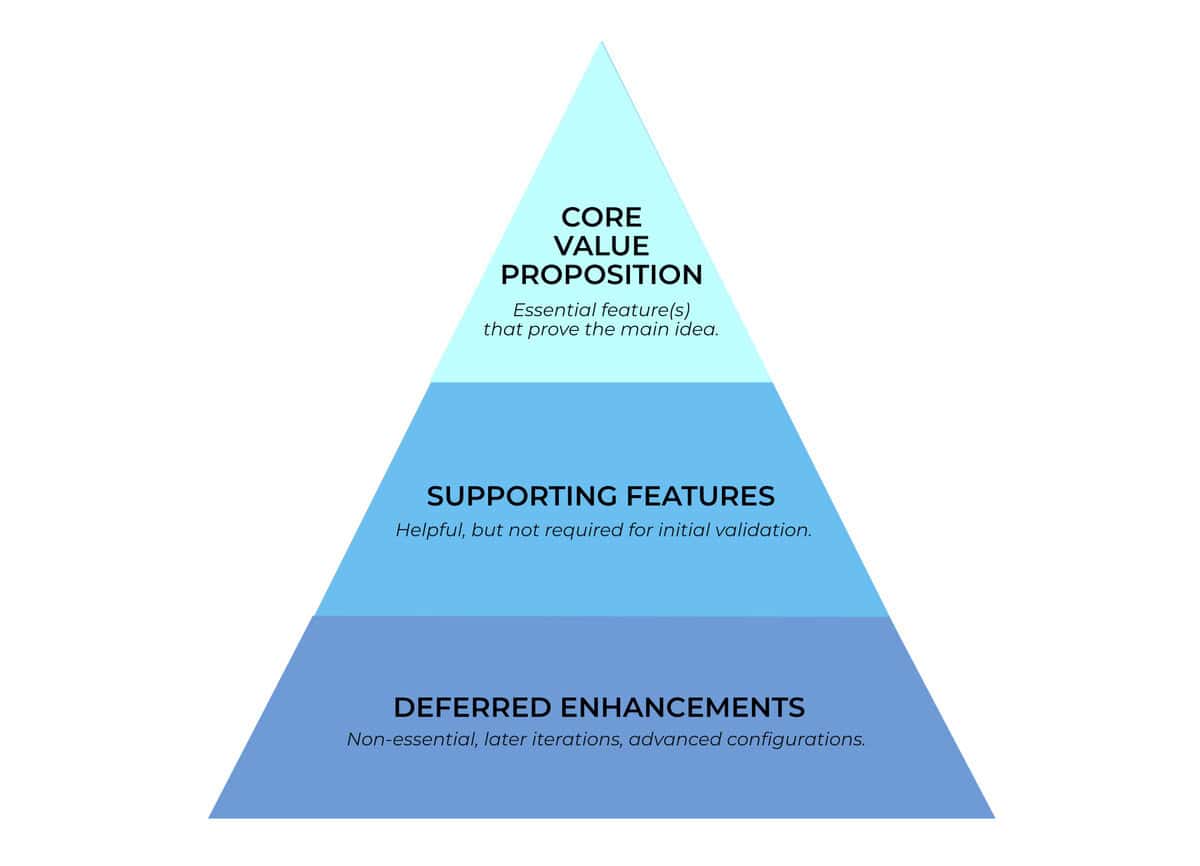

For early-stage companies, the Minimum Viable Product (MVP) serves as the first measurable step toward validating a business concept. It is not simply a smaller version of a full product, but a disciplined approach to identifying the core problem, selecting the essential features that address it, and releasing a functional version as efficiently as possible. In 2026, building an MVP involves balancing speed with strategic clarity, ensuring that limited resources are directed toward functionality that directly supports learning.

The concept of an MVP has evolved beyond the idea of a minimally functioning prototype. Today, an MVP typically includes:

AI increasingly supports MVP creation and prototyping by accelerating early development cycles. Teams use AI-assisted tools to generate interface mockups, scaffold code, prototype core workflows, and quickly iterate on features based on feedback. This allows startups to move from concept to testable product faster while keeping scope tightly controlled.

Modern users expect higher baseline quality than a decade ago, even in early-stage products. As a result, MVPs increasingly need to demonstrate reliability, intuitive UX, and basic performance benchmarks while limiting the scope to only the most essential elements.

The key to an effective MVP is identifying the minimum set of features that validate the product’s core hypothesis. This requires:

Well-scoped MVPs tend to focus on one or two user journeys rather than full product ecosystems. This helps eliminate unnecessary engineering work and shortens the time to release.

An efficient MVP process often follows a structured sequence, with continuous input from founders, stakeholders, and early users:

Teams work closely with the client to clarify business goals, define success criteria, and identify technical and budget constraints. Early alignment ensures that development priorities reflect real customer needs rather than assumptions.

UX designers translate client requirements and user scenarios into navigation and interaction models. Early prototypes are reviewed with stakeholders or test users to validate flows before engineering begins.

Engineers build only the functionality required to support the primary user journey, often incorporating client feedback on scope trade-offs and feature priorities. Lightweight backend services or managed platforms are selected to keep iteration fast.

QA focuses on stability and usability, while clients review interim builds to confirm that the product aligns with expectations. Feedback from stakeholders or early users informs small but targeted refinements.

The MVP is released to a controlled audience, pilot customers, or internal users. Client teams review early usage data and feedback to assess whether the concept resonates and to decide on next development steps.

Unlike full product development, the MVP process remains intentionally linear. Its purpose is not to satisfy every requirement, but to enable client-driven learning, reduce uncertainty, and guide informed decisions about future investment and product direction.

Because MVPs rely on a narrowed scope and modern development tools, delivery timelines are typically measured in weeks rather than months. Compact, cross-functional teams, often composed of 2-5 engineers, a UX/UI designer, and a product lead, are well-suited to this work. Their size allows for rapid alignment and smooth handoffs, reducing the time spent waiting on decisions or dependencies.

While the exact timeline varies depending on complexity, many early-stage products reach MVP readiness within six to ten weeks when requirements are clearly defined and the roadmap remains focused. Longer timelines generally result from scope expansion rather than technical limitations.

The MVP marks the beginning of product development, not the end. Once released, teams typically pivot to:

This phase (which follows the MVP) determines whether the product successfully moves from concept validation to sustainable growth.

Selecting the right software development partner with early-stage startup experience is a strategic decision for early-stage companies, particularly when internal resources are limited or the technical scope extends beyond the team’s expertise. Strong development partners contribute far more than engineering capacity. They provide the structure, oversight, and domain knowledge necessary to keep a product on track during periods of rapid change. In environments where execution speed and clarity are critical, these capabilities directly influence the quality and reliability of the final product.

A capable partner brings comprehensive technical proficiency spanning backend development, frontend engineering, cloud infrastructure, and quality assurance. This breadth is essential during the early stages of product development, when architectural decisions must support long-term scalability despite being implemented quickly. Mature teams understand how to design systems that can evolve, even if the MVP relies on simplified foundations.

In addition to engineering depth, strong partners introduce established development practices, including guidance on technology stack selection, code review standards, environment configuration, continuous integration pipelines, and automated testing. These processes maintain product stability while enabling rapid iteration.

Effective collaboration requires more than technical execution. Strong development partners also contribute product awareness, helping refine user flows, challenge assumptions, and identify opportunities to simplify the initial release. Their experience with UX design and early-stage product architecture reduces the likelihood of developing features that do not directly support user value.

This cross-functional capability ensures the product remains coherent as it grows. Partners that understand both design and engineering can help teams avoid fragmented experiences, overly complex workflows, or architectural decisions that limit future development.

As cloud adoption grows (supported by the fact that 90% of companies will operate in hybrid cloud environments by 2027, and 60% rely on managed service providers for public-cloud workloads) operational reliability becomes a differentiating factor. Strong partners understand how to manage cloud services, monitor performance, implement basic observability, and maintain secure deployment pipelines.

Security is another core responsibility. Even early-stage products must address data protection, access control, and infrastructure security from the outset. This typically includes designing authentication and authorization flows, implementing secure data storage and encryption practices, configuring role-based access, securing APIs and third-party integrations, and establishing basic monitoring and incident-response procedures. Experienced partners help startups apply these controls pragmatically, reducing exposure to common vulnerabilities while aligning early architecture with industry security standards.

Technical work must support the broader goals of the business. Strong development partners bring experience across multiple product lifecycles, enabling them to anticipate challenges related to scaling, budgeting, and roadmap planning. They help transform high-level ideas into actionable initiatives and ensure technical priorities reflect the company’s strategic objectives.

This includes advising on cost optimization, balancing short-term delivery speed with long-term maintainability, and identifying areas where temporary engineering shortcuts are appropriate, or where they may hinder future progress.

Reliability is reinforced through communication and delivery discipline. Strong partners maintain predictable reporting structures, run consistent sprint cycles, and ensure all stakeholders have visibility into progress. Clear documentation, defined communication channels, and structured feedback loops reduce the likelihood of misalignment, especially in distributed teams.

These practices support sustainable collaboration as the product evolves from MVP to a more robust release. As requirements expand, partners with strong collaboration habits help maintain continuity and reduce friction across engineering, design, and product functions.

The right development partner does more than write code; they bring clarity, structure, and long-term thinking to every stage of product growth.

Selecting a software development partner is a strategic decision that affects product quality, delivery speed, and the reliability of future releases. For startups, the process benefits from a structured, step-by-step approach rather than relying on informal impressions or price comparisons alone. The following framework outlines a practical way to evaluate potential partners and reduce the risk of misalignment.

Before approaching vendors, the startup should align internally on what is needed. This includes defining the scope of services and responsibilities (such as product discovery, UX design, engineering, security, and ongoing support), along with product’s scope, expected outcomes, timeline, budget range, and preferred collaboration model. A clear internal brief helps filter out partners who cannot meet core expectations and prevents scope from drifting during negotiations.

The next step is to identify partners whose expertise aligns with the startup’s domain, technology stack, and stage of growth. This typically involves reviewing portfolios, case studies, industries served, and team composition. At this stage, the aim is not to make a final choice but to narrow the field to a few candidates who can realistically support the product.

Once a shortlist is established, the focus shifts to technical depth. This involves assessing experience with relevant frameworks, architectural patterns, cloud platforms, and security practices. If possible, a technically skilled person on the startup’s side should review code samples, discuss architecture decisions, and ask how the team would approach concrete aspects of the project.

Process alignment is as important as technical ability. Startups should understand how the partner structures sprints, manages backlogs, handles change requests, and communicates progress. It is also important to clarify which tools are used (for example, Jira, Linear, Slack, or similar), how often demos occur, and how stakeholders are involved in decision-making.

Unlike general technical competence, which focuses on feature delivery, early decisions around cloud architecture, security controls, and data handling define a product’s long-term scalability, compliance, and risk exposure. A reliable partner should demonstrate experience with cloud infrastructure, secure deployment practices, observability, and analytics integration to ensure that early architectural choices do not create costly constraints as the product grows.

Beyond delivery practices, the partnership must be workable from a business perspective. This includes discussing pricing models, expectations about change in scope, intellectual property ownership, and exit conditions. It is also useful to understand how the partner thinks about long-term collaboration: whether they can support the product beyond the MVP phase and how they handle team continuity.

Finally, startups should validate claims with external references or previous clients, ideally in similar industries or product types. Where budget and timelines allow, a limited pilot engagement, such as a discovery phase, prototype, or small feature set, can provide a practical view of how the partner collaborates before committing to a longer contract.

| Step | Focus area | Key questions for potential partners |

|---|---|---|

| Define requirements | Scope, goals, constraints |

|

| Shortlist candidates | Domain fit and experience |

|

| Evaluate technical competence | Stack, architecture, quality |

|

| Assess process and communication | Methodology, visibility, collaboration |

|

| Check cloud, security, and data practices | Reliability, security, analytics |

|

| Review business alignment | Pricing, contracts, continuity |

|

| Validate with references or pilot | Proof and risk reduction |

|

This structured approach helps startups evaluate partners systematically, focusing on both technical and operational dimensions rather than relying solely on cost or initial impressions.

Website: www.devsdata.com

Team size: ~60 employees

Headquarters: Brooklyn, NY, and Warsaw, Poland

Founded: 2016

As the previous sections show, early-stage product development requires a partner with technical depth, cross-functional expertise, and the ability to move quickly without compromising the long-term integrity of the product. DevsData LLC aligns with these requirements through its experience, global presence, and consistent delivery standards.

Headquartered in New York, NY, and Warsaw, Poland, DevsData LLC has been operating for over nine years, supporting both emerging startups and globally recognized corporate clients. The company specializes in software development for startups, combining engineering capability with product-awareness and execution discipline. Over the years, it has completed more than 100 software projects for over 80 clients, offering teams experienced in navigating the complexity and time pressure typical of early-stage development.

A distinguishing strength of DevsData LLC is the composition of its engineering talent. The company employs Google-level in-house engineers, alongside US-based specialists, ensuring that technical decisions and implementation quality meet standards expected by high-growth technology organizations. Many developers on the team bring 10+ years of experience specifically in software development for startups, allowing them to anticipate challenges related to architecture, scalability, and product evolution.

DevsData LLC also brings domain expertise in areas that increasingly shape modern startup products, including Big Data and Machine Learning. These capabilities are particularly relevant as more early-stage companies integrate data-driven features, intelligent automation, or real-time analytics into their MVPs and subsequent releases.

The company’s track record extends across industries and geographies. DevsData LLC has delivered projects for corporate clients in the United States, Europe, and Asia, as well as high-growth startups in markets such as the US and Israel, providing insight into both enterprise-level expectations and the agility needed in early-stage environments. Its consistent quality is reflected in its 5/5 ratings on Clutch and GoodFirms, demonstrating strong client satisfaction and reliability.

With technical depth, global experience, and a proven track record in delivering products under demanding conditions, DevsData LLC offers the capabilities that startups require: rapid development, scalable architecture, rigorous engineering standards, and a collaborative approach suited to evolving product needs.

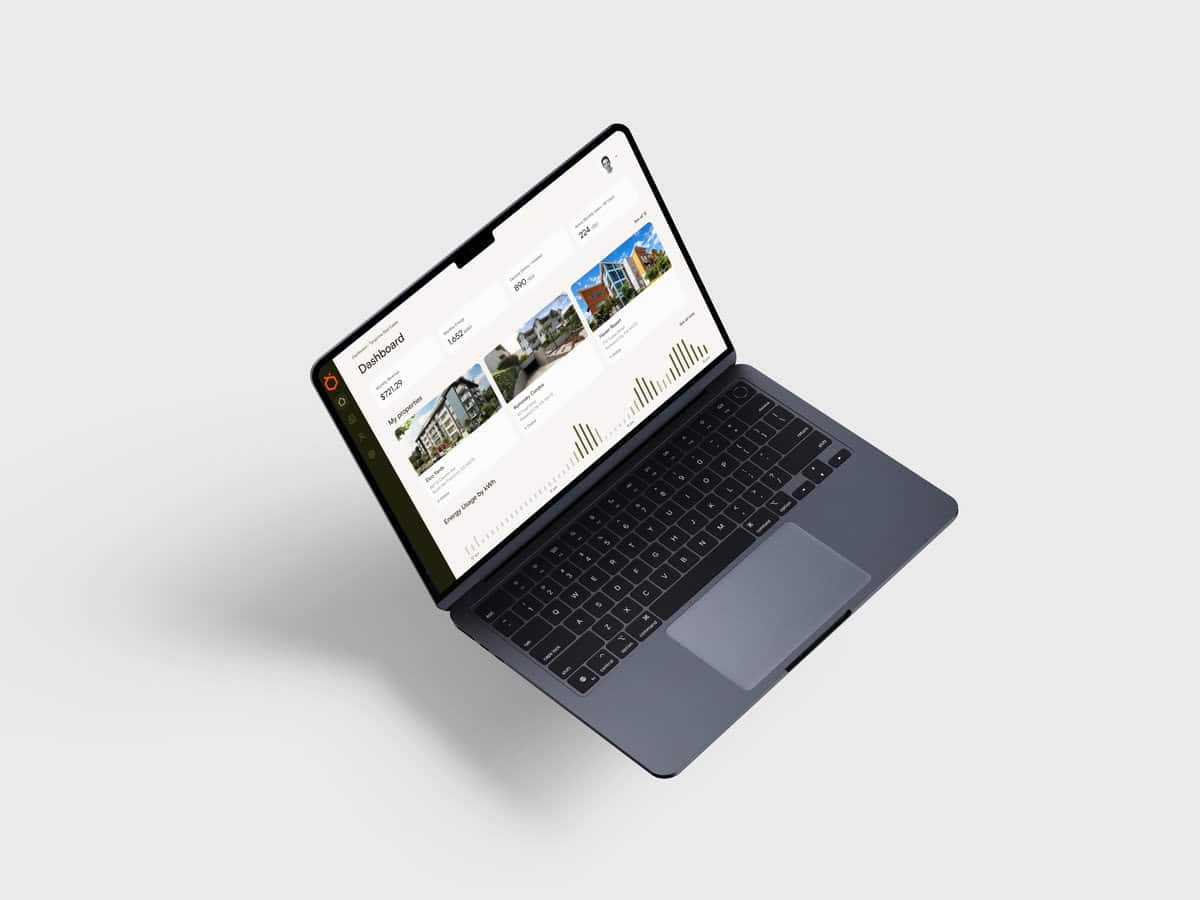

Recently, DevsData LLC collaborated with Orange Charger, a fast-growing San Francisco–based startup focused on enabling accessible home EV charging for multi-unit residential buildings. As the company prepared to scale its hardware offering – smart 240-volt charging outlets – it needed a software platform that would securely connect tenants, property owners, and charging devices in one unified ecosystem. DevsData LLC was selected as the software development partner to build this digital foundation.

Our role and approach

DevsData LLC delivered an end-to-end mobile solution that aligned with the client’s hardware-driven business model. The project combined backend architecture, frontend development, UX/UI design, and close collaboration with Orange Charger’s product and engineering teams. A compact cross-functional team ensured rapid progress, clear ownership, and the ability to iterate quickly in response to evolving requirements, an approach well suited to an early-stage startup preparing for market expansion.

The development strategy emphasized scalability, security, and seamless integration with real-time energy data. The mobile application, built using Flutter, supports automated billing, consumption tracking, and Bluetooth-based charging activation. On the backend, secure authentication, reliable communication with charging hardware, and automated settlements between tenants and property owners were core priorities. The system architecture was designed to support expansion across multiple buildings and hardware models without requiring disruptive changes.

Outcome

The collaboration resulted in a fully operational platform that simplifies EV charging in multifamily housing. Tenants can start charging sessions, monitor usage, and manage payments directly from their phones, while property owners gain tools for tracking consumption and reducing administrative work through automated payouts. The platform now supports Orange Charger’s continued rollout across the United States and serves as a long-term foundation for new features and integrations.

If you’re building a software product and need a partner who understands the pace, constraints, and technical demands of early-stage development, DevsData LLC can support you at every step: from defining the architecture and building an MVP to scaling your platform as your user base grows.

Reach out to discuss your project and explore how our team can help you deliver a reliable, scalable product with clarity and speed. Email us at general@devsdata.com or visit our website at www.devsdata.com.

Developing software as an early-stage company requires a balance of disciplined methodology, technical adaptability, and clear strategic focus. Startups operate in an environment where requirements shift quickly and resources must be used with precision, making the structure of development teams, the choice of tools, and the integration of data-driven decision-making central to successful product delivery. The right approach allows teams to move from concept to a functional MVP efficiently, validate assumptions early, and build a foundation capable of supporting long-term growth.

Modern frameworks, cloud-native platforms, and rapid prototyping tools enable faster execution than ever before, but technology alone does not guarantee progress. Strong development partners contribute the processes, architectural guidance, and cross-functional capabilities that ensure each iteration aligns with business objectives. When combined with well-defined requirements and consistent communication, this partnership model reduces risk and positions early-stage products for smooth evolution as they scale.

As the landscape of digital products continues to grow in complexity and competition, startups benefit most from development models that emphasize speed, clarity, and continuous validation. A structured approach, supported by experienced engineers and a partner with proven expertise, helps turn early ideas into reliable, scalable solutions ready for market expansion. DevsData LLC follows this philosophy by combining disciplined engineering practices with an iterative, collaboration-focused workflow tailored to early-stage needs. Their teams prioritize clear communication, thoughtful architecture, and rapid delivery cycles, ensuring that product decisions are grounded in both technical rigor and business objectives.

Frequently asked questions (FAQ)

DevsData – your premium technology partner

DevsData is a boutique tech recruitment and software agency. Develop your software project with veteran engineers or scale up an in-house tech team of developers with relevant industry experience.

Free consultation with a software expert

🎧 Schedule a meeting

FEATURED IN

DevsData LLC is truly exceptional – their backend developers are some of the best I’ve ever worked with.”

Nicholas Johnson

Mentor at YC, serial entrepreneur

Categories: Big data, data analytics | Software and technology | IT recruitment blog | IT in Poland | Content hub (blog)